Table of Contents

- Growth in Indians Self-Monitoring Their CIBIL Report to Access Credit ...

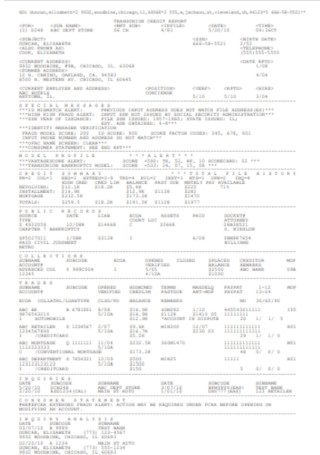

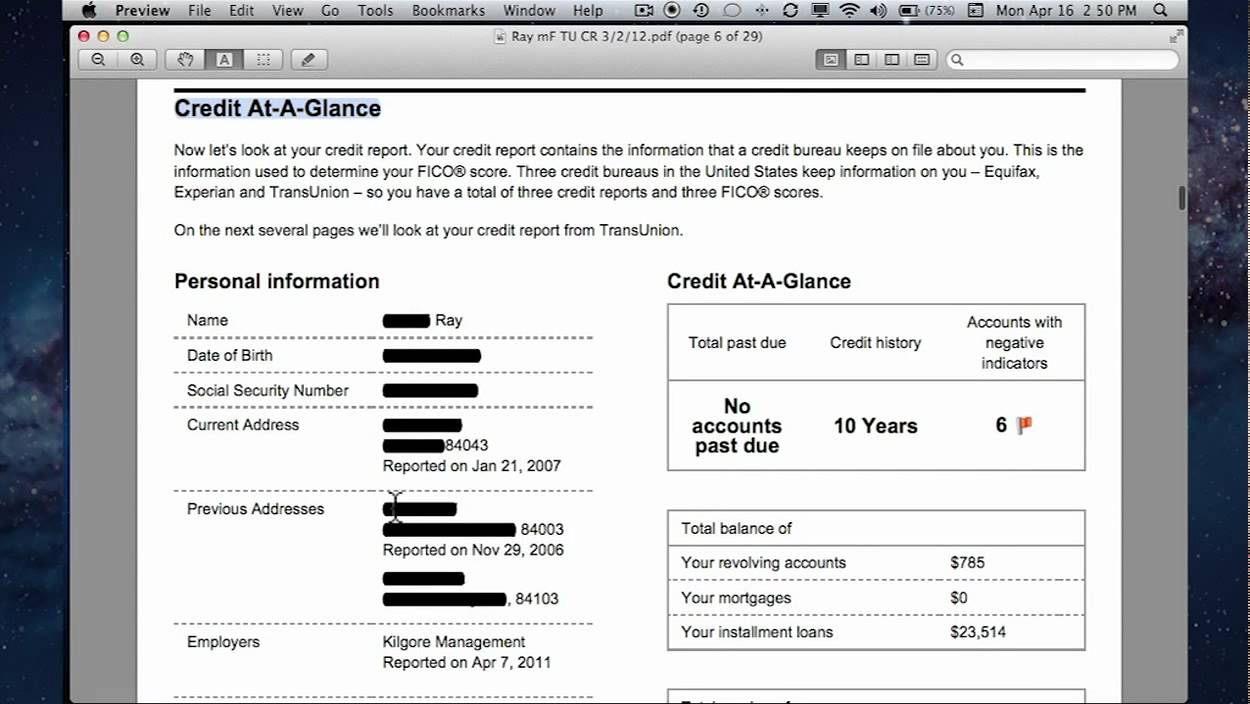

- Sample Credit Report Transunion

- Online form to cancel your Transunion subscription

- TransUnion: Credit Monitoring - Apps on Google Play

- TransUnion Company Profile & Overview | AmbitionBox

- 12+ FREE Transunion Credit Report Samples to Download

- How to read your TransUnion credit report? | Milesopedia

- Major Credit Transunion Credit Scoring And Reporting Complete Guide Fin ...

- Transunion Photos and Premium High Res Pictures - Getty Images

- TransUnion and executives charged with violating law enforcement order

What is a TransUnion Credit Report?

What Information is Included in a TransUnion Credit Report?

Why is a Good TransUnion Credit Report Important?

A good TransUnion credit report is essential for several reasons: Loan Approvals: A good credit report can increase your chances of getting approved for loans and credit cards Interest Rates: A good credit score can help you qualify for lower interest rates on loans and credit cards Credit Limits: A good credit report can help you qualify for higher credit limits Employment and Housing: Some employers and landlords use credit reports to evaluate your creditworthinessHow to Check Your TransUnion Credit Report

You can check your TransUnion credit report for free once a year from the official website of TransUnion. You can also purchase a copy of your report from the website or request a free report by mail. It's essential to review your report regularly to ensure that it's accurate and up-to-date. In conclusion, a TransUnion credit report is a vital tool for maintaining good financial health. By understanding what's included in your report and how it's used, you can take steps to improve your credit score and increase your chances of getting approved for loans and credit cards. Remember to check your report regularly and dispute any errors to ensure that your credit report is accurate and reflects your true creditworthiness. By taking control of your credit report, you can unlock your financial future and achieve your long-term goals.Keyword: TransUnion Credit Report, Credit Score, Financial Health, Credit Report Agencies, Loan Approvals, Interest Rates, Credit Limits, Employment, Housing